The loan to be applied for can be found with the help of the Mortgage Loan Calculator which is dependent on the monthly income of an individual and gives an idea of the kind of loan that person can afford. After getting that idea the consumer can calculate the maximum price which he can afford while buying his home and be relieved of his stress. This saves lots of time for the consumer and he gets a fair amount of ideas about the loan which is affordable and also easily available. Since the mortgage loan calculator gives an idea about the loan it helps the consumer in adjusting his amortization and also finding out what amount he has to pay and for how many months, if he makes certain pre-payment every month.

If someone desires to have a loan or wants to apply for a loan, gathering some information about the same will help in getting the best loans according to your needs, wishes, and requirement. All this can become possible only with the help of a mortgage loan calculator which gives more information on financing. This will help in getting rid of the lenders and also to be dependent on them since it is the consumer who is responsible for the loan and not the lender.

Mortgage Loan Calculator

The main use of a Mortgage loan calculator is that it can give all the required information, the factors, and terms that are involved in the mortgage loan. There are certain advantages of the Mortgage loan calculator which make it even more useful for the consumer as it will help in finding:

- The monthly payment on loans can be estimated.

- Closing costs can also be estimated.

- The loan amount a lender will be lending depends on income status.

- Average estimation of loan for your house.

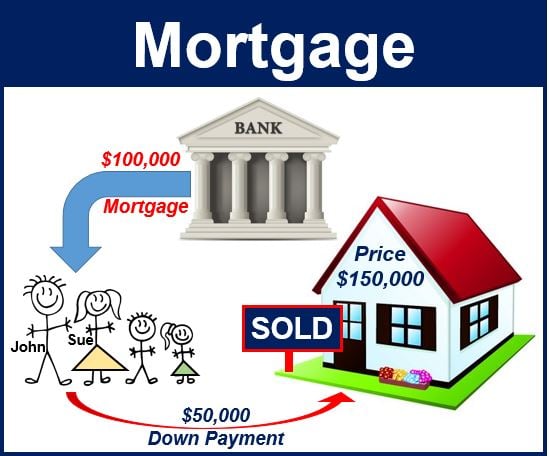

- Downpayments.

- Private mortgage insurance.

- The monthly payments to be made to reduce the time period

- Different loans with monthly payments and other details.

Calculate Your Mortgage Payment Online Now!

Types of Mortgage Loan Calculators

The monthly payments to be done of the principal and interest can be calculated with the help of a mortgage loan calculator. After providing a few details such as the down payment, and the time period, the consumer can get the approximate monthly payments to be done and also can find out about the interest rate.

There are different types of mortgage loan calculators such as:

- APR calculator

- ARM APR calculator

- Additional payment calculator

- The interest-only loan comparison calculator

- Monthly payment calculator

- Savings Calculator

- Rent vs Buy calculator

- Budget calculator

Advantages of Free Mortgage Calculator

When you are planning to buy a home and looking for mortgage loans then it is very important for you to have an idea as to how much loan you can afford, what will be the monthly payments, and what can be the term of the mortgage. After knowing all these basic things you can decide the type of mortgage most suitable for your needs. In order to help you with all these queries there is a special tool designed by real estate persons called a Mortgage calculator. There are several uses of the mortgage calculator for people seeking mortgage loans some of the advantages of it are.

Mortgage Loan Calculator enables you to:

- Find out what kind of mortgage works best for you fixed rate mortgage, or an adjustable-rate mortgage

- Determine the amount of mortgage you can afford

- Determine your new monthly mortgage payments.

- Calculate payments on debt consolidation mortgage loans and see your monthly savings!

- Find out how much you can afford to borrow

- Determine your repayments using time scales and interest rates.

There are different mortgage calculators available for different calculation

- Mortgage Calculator.

- Amortization Schedules.

- Loan Payment Calculator.

- Mortgage Refinance Calculator.

- Home Affordability, Mortgage. Loan Comparisons calculator.

- Pre-Qualify Calculator and Early Pay Off Calculations.

Use of Mortgage Rate Calculator

Loans are needed for many people so it is necessary to know the type of loan that best suits or meets the needs of the individual and depending on those results the consumer can opt for the right loan. The consumer can get all this information with the help of a Mortgage Loan calculator which will give the desired results depending on the monthly income. The maximum price that is affordable for the consumer at that monthly income is also calculated by the mortgage loan calculator. It will also help the consumer in determining how much amount can be saved if a certain loan amount is paid every month and thus also knowing the months or years that would get reduced.

It is advisable to use a mortgage calculator before you start applying for a loan. You can get ample information about different financing options that best suit your needs. These mortgage rate calculators will guide you virtually through each and every step of the buying and selling process. There are various advantages to using these calculators.

Mortgage Rate Calculator helps in :

- Getting information on all factors involved in the mortgage loan.

- Providing the average estimate of how much loan you can afford.

- Estimating monthly payments on loans.

- Help in determining how much loan lenders will lend depending upon your current income status.

- Compare the different loans with their monthly payments, closings, and other fees.

- Answer some of your crucial questions about down payments, private mortgage insurance, buying point to lower your interest rate, etc

- Estimate your closing costs with these calculators.

What is Interest Only Mortgage Calculator?

If are you planning to apply for a mortgage loan and are confused as to how much you can afford, what will be your monthly payment etc. then you can make use of mortgage calculators. No matter what you are looking for a home equity loan, a refinancing mortgage, or a home equity line of credit, it is advisable to make use of our interactive, easy-to-use, mortgage calculators.

These Mortgage calculators provide mortgage calculations and other related information about home mortgages and mortgage interests. In order to confirm that the decision made for financing the home is correct, mortgage calculators will help you out. It will enable the consumer in getting quick and easy access to mortgage calculations thus helping in the process of investigating all about mortgage options and home-buying needs.

There are different Mortgage Loan calculators available in the market some of which are:

- Mortgage calculators

- Amortization Schedule

- Mortgage Payment & APR Mortgage Calculator

- Early Mortgage Payoff Calculator etc.

But sometimes it is confusing and the consumer tries to find where he can get a mortgage calculator that will help in knowing how much interest-only payments have to be done if that option is chosen.

What is a Mortgage Refinancing Calculator?

There are different mortgage refinance calculators offered by companies online. These refinancing calculators will help us to decide whether or not refinancing the current mortgage be done at a lower interest rate. It will help us by calculating the monthly payment and also the number of months it will take to break even on the refinance costs. Not only that it will also help you to determine changes in mortgage payments. If you consider refinancing a loan this calculator even helps in determining how long it would take to recover closing costs associated with refinancing.

Advantages of Mortgage Refinancing Calculator

A refinanced mortgage is one in which a borrower pays down an old loan with a new loan. People who refinance a mortgage tend to do so in order to get a lower interest rate, lower their payments, or take cash out of their home equity. It is very important for borrowers to have a clear objective in mind when refinancing. Here are a few common reasons why people consider refinancing.

- To Pay Off Credit Cards And Other Debt

- To Access Extra Cash

- To Lower Your Monthly Mortgage Payment

- To Convert a Fixed-Rate Mortgage to an Adjustable Rate Mortgage

- many more.

Applying for a mortgage is the biggest financial decision so you need to be very careful while doing so. You need to understand beforehand the mortgage monthly payment, the interest rates, whether you will be able to save some extra cash or not, etc. In order to help you out with this query there are tools called mortgage loan calculators specially designed to help borrowers.

About Karl’s Mortgage Calculator

Buying a home is the biggest financial decision you make so it is important for you to understand the various cost and benefits involved in the mortgage so that you can get a better deal.to help you with these concerns many companies have come up with a tool called a mortgage calculator. These mortgage calculators are a special type of financial calculator that will help you plan for a home purchase. Depending upon the interest rate, down payment, and length of the mortgage, it gives you a general idea about monthly mortgage payments on your mortgage.

These mortgage loan calculators are specially designed for people to have an idea of how much house they can afford, determine monthly payments, and how much they can deduct from their taxes. compare renting a house vs. buying it and many more. The best thing about this is that the Mortgage calculator can be accessed online. There are many websites online which provide online mortgage calculators. By filling up just the simple form you can get the details you need that too fast and easily in the comfort of your home. One such online mortgage calculator is the Karls mortgage calculator.

What is Karl’s Mortgage Calculator?

Karls mortgage calculator is an online mortgage calculator which helps in calculating monthly mortgage payments. This online mortgage calculator generates graphs showing monthly and yearly repayments, amortization, balance, and other figures. It easily recalculates mortgage repayments through graphical sliders and charts. Generally, this calculator can be used in the USA, European Union, Canada, and Great Britain.

Mortgage Refinance

A mortgage is a loan to finance the purchase of your home and refinance means changing your mortgage lender with the same amount but with lower interest rates which will help you save thousands on the loan and eventually can be used for your own purpose either for child safety or anything to fulfill your dream.

Advantages of using Mortgage Refinance Calculator:

- To lower monthly payments.

- To get Extra cash.

- To shorten the loan terms.

- Change from adjustable rate mortgage to fixed rate. and many more.

What is a Mortgage Refinance Calculator?

There are many instances when the interest rates go down giving us the possibility for us to refinance our mortgage but we get confused about whether it is the right time to refinance. What will be the monthly payment if we refinance and so on? In order to get out of this confusion we have a calculator called the mortgage to refinance calculator.

Mortgage Amortization Calculator

When hearing about these calculators few questions that arise in mind are :

- Who this calculator is for?

- What does this calculator do?

The answers to these above queries can be found in the Mortgage Amortization Calculator. This calculator helps in finding out the monthly amortization on FRM, the expected appreciation in the property value that the user wants, and also the loan balance and property value expected ratio. All these help in knowing how much time will it take for the loan balance to come down to the desired level. The borrowers can thus get an idea of the time frame that would be required and thus would find out the time taken for amortization on FRM that is combined with the appreciation in property value to lower the other ratio. The loan balance and property value ratio would reduce to a certain level depending on the amortization time.

Generally, this amortization calculator shows the breakdown between principal and interest in your mortgage payments.

As soon as you submit the details calculation will show you amortization tables with complete mortgage amortization schedules for the loan. Monthly payments depend on a few factors like principal amount, length of the loan, and annual interest rate. These calculators will help you compute the loan’s monthly payment based on these factors. When calculating the monthly payment you need to be very careful because as soon as there is a change of any one variable you need to recalculate the monthly payment before creating an amortization table.

The calculations obtained from the various calculators used in mortgages are just an estimate and none can give an exact idea about the outcome or results. This Mortgage Loan Calculator can only be used for getting the result of consolidation into equity loans of certain debts. If the home equity loan is refinanced again then the monthly payments that have been earlier known would get increase and thus would also increase the amount that has to be paid. It is always advisable to get a consultation from the tax advisor to find out about the interest for tax purposes as well as before you change the current home equity loan.

What is Mortgage Calculator UK?

If you are planning to buy a home in the UK it is very important to get the mortgage loan that best suits your needs. No matter whether you are a first-time buyer or looking to re-mortgage, it is advisable to get an estimate of the monthly payments and maximum borrowing limits. You always need to keep a track of the interest rates and must be aware that the monthly payment may rise or fall depending upon the rates prevailing in the market. You also need to keep in mind that the cost of your mortgage will also depend on certain other factors such as the mortgage term, life insurance, and income protection insurance.

In order to get an approximation of monthly payments there are many mortgage calculators specially designed for these purposes.

These Mortgage Loan calculators will help you to know what type of loan you can apply for, depending upon the monthly income it determines the kind of loan that is affordable. Not only that it also calculates how much price you can afford for buying a home. All the borrowers in the UK find these mortgage calculators very flexible as they can get more information about the loans very fast and easily.

Advantages Mortgage Calculator UK

The advantages of using Mortgage Calculator UK are

- Find out how much your monthly mortgage repayment will be at a given interest rate.

- Find out how much you can afford to borrow based on your income.

- Compare repayment costs on different types of mortgages.

- Find out how much time and money you could save by overpaying on the mortgage.

- Find out the additional costs of products/services that are related to mortgage example stamp duty, repayment protection insurance, buildings, etc.

- Compare mortgage deals between various lenders.

What is a Biweekly Mortgage?

Mortgage payments are usually made in full once a month but if the consumer makes the mortgage payments every two weeks or biweekly it would help the consumer in making some savings. The consumer can have savings if he opts for making half of the mortgage payment every two weeks instead of a full mortgage payment once a month. The biweekly calculator can be used to find out how much savings can be achieved if the mortgage payments are done biweekly and not monthly. There will be an increased flow of cash if you pay off the mortgage loan ahead of schedule since it would save the extra amount of time for which the mortgage payments have to be done. Though there would be an extra mortgage payment per year it would not get noticed after you see the increase in cash flow.

The consumer would be able to find out that they can save thousands of dollars by using a biweekly mortgage plan as well as they can pay off their home loans 10 years in advance which surely means a lot of saving for the consumer. This amount can then be utilized by the consumer according to his will for the family, studies of children, and expenditures. The mortgage payments to be made would be 13 a year since there are 52 weeks in a year and this extra payment done in a year would help in making big savings in the interest for the rest of life. All these basics can be found using a mortgage loan calculator.

What is Mortgage Interest Calculator?

Buying a home is a very important as well as confusing experience and obtaining a mortgage loan is a very easy way to finance your home. But there is a possibility of confusing yourself due to many mortgage loan options and you are not able to decide as to which one is the best mortgage loan. In order to come out of this situation you can make use of a mortgage interest calculator.

What is an Interest Rate Calculator?

The interest rate calculator will help you calculate how much monthly mortgage interest payments would be at different interest rates. It is an easy-to-use Mortgage loan calculator which displays an Amortization Graph, Annual Table, Monthly Payment Chart, etc.

It shows you the ways of saving money on interest if you plan to refinance or apply more money on principal each month. These interest rate calculators are used to calculate the monthly payment.

You can also use the program to calculate the interest accumulated on a loan or deposit over a selectable period. Also, calculate the number of interest days between the two dates. You can also find some calculators online which will help us calculate interest rate rise, i.e. how much will it cost over the life of your loan. There are thousands of combinations of loans including, fixed, variable, capped, repayment and loads more. A mortgage interest calculator will help you search for a mortgage that best suits your needs.

All About Online Mortgage Calculator

Buying a home is the biggest financial decision you make so it is important for you to understand the various cost and benefits involved in a mortgage so that you can get a better deal. To help you with these concerns many companies have come up with a tool called a mortgage calculator.

These calculators are specially designed for people to have an idea of how much house they can afford, determine monthly payments, and how much they can deduct from their taxes. compare renting a house vs. buying it and many more. The best thing about this is that the Mortgage calculator can be accessed online. There are many websites online which provide online Mortgage Loan Calculator.

By filling up just the simple form you can get the details needed and that too fast and easily in the comfort of your home.

Online Mortgage Calculators will enable you

- To determine an affordable mortgage and produce other valuable information about your loan.

- To determine how much house you can afford based on the income and debt information you supply with our payment calculator.

- Calculate monthly mortgage payments based on loan amounts, interest rates, and loan terms.

- To determine how much extra to pay in the monthly mortgage payments to pay off the loan in the number of years you select.

- To compare up to three different mortgage products.

- You can get the Amortization Schedules, Amortization Calculator, and Tables based on the loan amount, interest and term, and many more.

There are many companies online which provide you with a mortgage calculator, by just filling out the simple form you may be able to access it. These online mortgage calculators are specially designed to help you determine the loan which is affordable but they do not recommend how much you should be borrowing and if at all you want the help of advisors you can contact them personally.

All about Canadian Mortgage Calculators

Looking for a mortgage Loan in Canada but are confused about the amount you can afford, or the monthly payments with the mortgage? Then don’t worry as there are different mortgage calculators which will help you to plan your home purchase, refinance or renewal, and many more.

There are many companies online which has compiled a list of calculators that will provide you within minutes the details regarding different aspects of a mortgage such as financial expenditures related to home buying, decision-related to lifestyle, and many more. You need to take some time from your busy schedule and explore the different calculator that best suits your needs. No matter what you are looking for a home loan, refinance loan, or home equity loan you just need to select the appropriate calculator and get the results.

You can find multiple Canadian mortgage calculators online which will help you to determine the best type of mortgage financing for you. As you decide on the option you can also apply for a free mortgage quote. Using these calculators is fast, free, and above all no obligation.

There are different Mortgage loan calculators offered by various companies in Canada depending upon the needs. These calculators are classified depending on the needs of the people.

The different types are:

- Mortgage Refinancing calculator & Home Equity Loan calculator

- Home Financing Calculator

- Rent vs. Own Calculator

- Mortgage Manager Calculator

- Amortization Schedule Calculator

- House Affordability Calculator many more